This is a talk I gave at Funding the Commons, an event put on by Protocol Labs for the sustainable funding of public goods and open source tech.

Out of curiosity, I had tried reading a few blockchain books for the general public and was horrified at what I found. This talk pinpoints where exactly the authors of these books went wrong and explores how to fix the misconceptions, even when there is no apparent market incentive to do so.

Download all slides as a pdf.

Transcript

Hi, my name is Kate Sills, and I’m a software engineer in the blockchain industry. Today I’m going to be talking about blockchain education as a public good.

I have a problem. Some of you might have the same problem I do. Here’s the problem: when I tell someone what I do, I often get two responses, neither of which are good.

“Isn’t it just a bunch of scams?”

Or… “Right on! I actually just put all of my retirement savings into [insert scam here]!”

There’s a lot that’s wrong with that, and my discomfort is the least important part. But I’d like to propose that one of the major problems is a knowledge problem. People are putting money into projects that are riskier than they realize, because they’re unable to evaluate blockchain projects. And it affects all of us, in that good projects are unfairly maligned if everything seems equally risky or scammy.

Let’s back up a bit. Why am I talking about this at Funding the Commons? Well, blockchain education is a public good, and I think I have a novel suggestion for how to fund it.

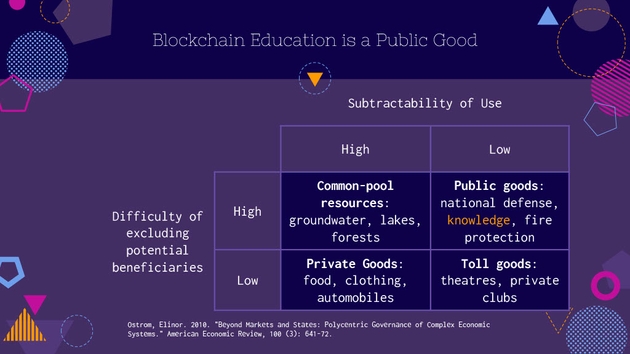

So Elinor Ostrom provides this chart in a 2010 paper. In it, we can see that for some goods, use of the good subtracts it from someone else. We call these rivalrous goods—that’s the category in the left column. Then for some goods, it’s very difficult to exclude non-payers. These are the non-excludable goods, and this is the top row. Ostrom points out that knowledge is a public good. It’s non-rivalrous and non-excludable.

What do I mean by blockchain education? Effective education is understanding and correcting a student’s already existing mental model.

We didn’t always realize this. In the traditional view of education, education is knowledge transfer. A teacher is giving a piece of information that is transferred directly to the student’s brain. It’s almost like a data download.

But we’ve discovered that a data download is not how the human brain works. What we actually do is construct mental models. There’s a great paper that I’m going to reference a few times that applies what we’ve learned about mental models in cognitive science to teaching physics. In the paper, Redish points out that our mental models may be contradictory, may be incomplete, may be confused with similar things, and may be used as a heuristic to save time that would otherwise be spent thinking.

To teach is to replace someone’s wrong mental model with a new, correct model. According to Redish, the proposed replacement must be understandable, plausible, and seen as useful. And, there must be a strong conflict with predictions based on the existing model.

Ok, so now that we know what we’re aiming to do, let’s try to see if we can understand the current mental models in the blockchain industry.

I chose to look at two books: The Truth Machine by Michael J. Casey and Paul Vigna, and Blockchain Revolution by Don Tapscott & Alex Tapscott. An economist told me that these are the books that he tells his students to read.

The books also have some incredible star power support. For example, here’s the blurbs for Blockchain Revolution. This isn’t even all of them.

I’m going to present some quotes from both of these books, and I want us to try to construct their mental models of how a blockchain works. I’m going to focus on one area in particular: digital signatures and public key cryptography.

First, let’s briefly look at the correct model. To create a digital signature, first you have to have a private key. A private key is essentially a random number. You keep this secret. Now you can sign messages with the private key. No one else can create your signature. No one can forge it.

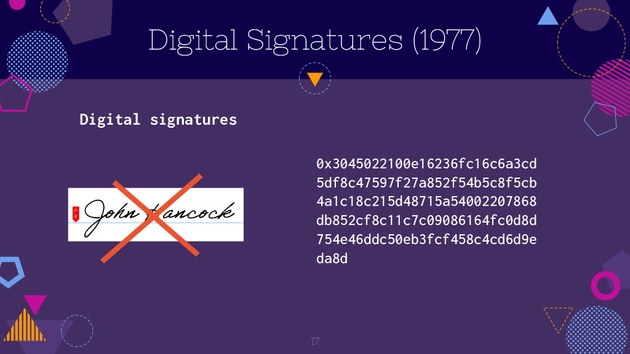

A digital signature is not an electronic signature. It’s not a digital image of handwriting. It’s data. So the signature on the left is not a digital signature. The data on the right is a digital signature.

It’s important that someone can verify your digital signature. To allow someone to verify your signature, you can derive a new number from your private key. This number you can share publicly - let’s call it a public key. Anyone who has your public key and the message you signed can verify your signature.

Digital signatures do not encrypt. You can think of it as a stamp on a document. Nothing about the document is hidden.

Signed messages are tamper-evident. Because a signature is only valid for a particular message, if that message changes at all, that signature is invalid.

Digital signatures don’t require a blockchain. Blockchains use digital signatures along with a number of other cryptographic primitives, but digital signatures existed long before Bitcoin and you don’t need a blockchain for digital signatures.

How exactly do blockchains use digital signatures? When you sign and submit a transaction to a blockchain, you’re creating a digitally signed message with your private key

Ok, so let’s take a look at what these very well-known books say. This one says: “We needn’t worry about weak firewalls, thieving employees, or insurance hackers. If we’re both using bitcoin, if we can store and exchange bitcoin securely, then we can store and exchange highly confidential information and digital assets securely on the blockchain.”

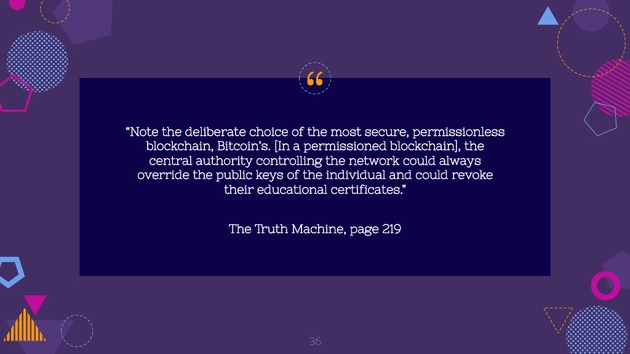

Ok, so part of the mental model is an extrapolation, that because we can store bitcoin securely, we should be able to store highly confidential information on the blockchain. This is wrong, but let’s continue.

“one of the most important non-currency applications of Bitcoin’s blockchain could be security itself”

Ok, so let’s add to our mental model that blockchains provide security generally. I wonder why they think that?

The book Blockchain Revolution says: the blockchain is encrypted, it uses heavy-duty encryption involving public and private keys.

Ok, let’s add that. Why do they think it’s encrypted?

They say it’s “rather like the two-key system to access a safety deposit box.”

If you’re not familiar with a safety deposit box (I wasn’t, I had to look this up), to open the box, it requires two keys at the same time - one from the bank employee and the other from the renter of the box. So two keys to open, and it’s very secure and private. So this is the mental model they have.

Let’s add “two keys to open” to our list.

They say that when a user signs their public key with their private key, that proves the user has control.

And they also say a signature entails combining two keys.

Let’s add those incorrect ideas.

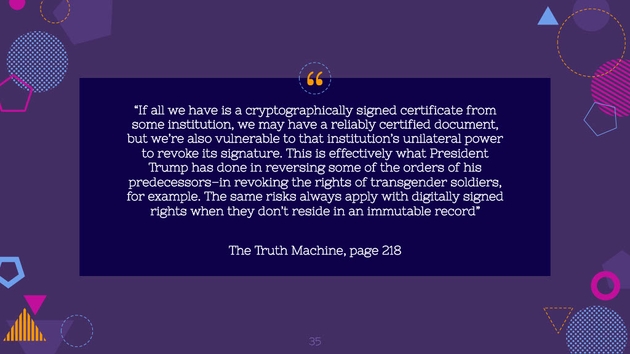

Here’s some more misconceptions. In this one, they say that if we have a digitally signed message, we still can’t guarantee that the signature is valid for the message. The digital signature doesn’t give us an immutable record.

Here’s another one. They say anyone who controls a blockchain can “override” keys whatever that means and invalidate digital signatures.

Ok, so we’ve created a mental model of digital signatures based on the quotes from the two well-known blockchain books. As you can see, much of this mental model is wrong.

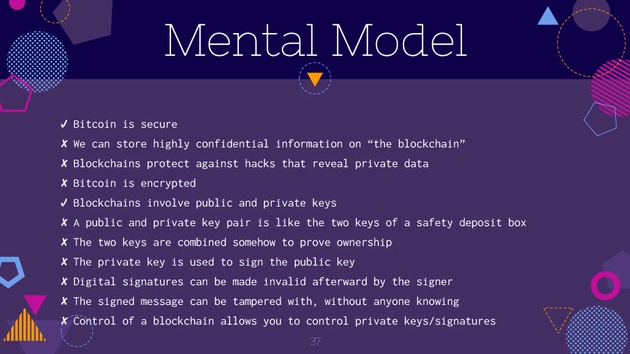

Unfortunately, these books aren’t just wrong about digital signatures. They’re wrong about lots of other things too. I didn’t have time to go into these other topics during this presentation, but here’s some more. They seem to think that blockchain consensus produces truth in some way, and that by providing a solution to the “double-spend problem,” blockchains can guarantee the uniqueness of assets generally.

So how can we fix the wrong ideas?

Understand the current mental model. Convey the correct mental model. Tell them something true that contradicts their current model. Aka, tell them something surprising.

There’s a few ways we can do that. The first is basically what I’ve been doing so far, which is reading and critiquing in talks, blog posts, etc. The second is actually holding formal user studies where we bring subjects in, ask them questions, etc. And the third thing, something that I’m really excited about, is creating surprising products.

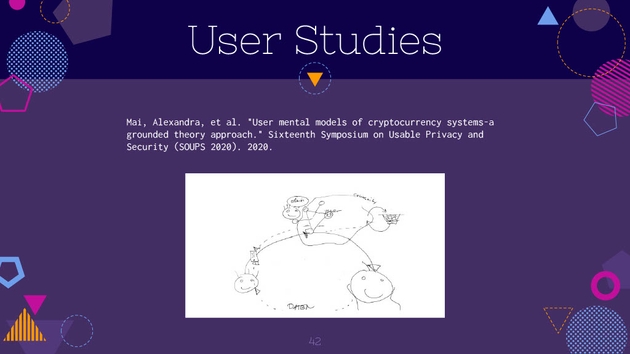

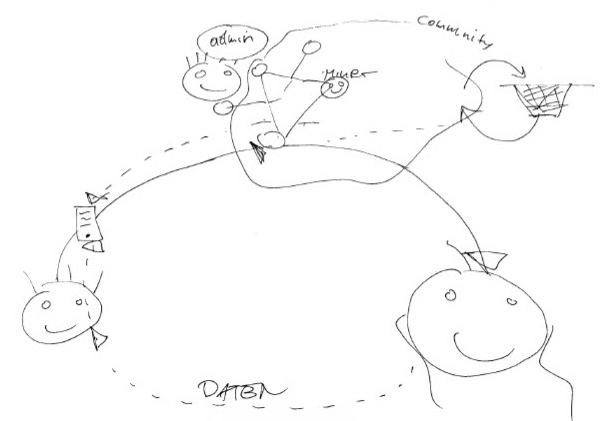

Here’s an example of a user study that I found really interesting. They brought about 30 people in, asked them to draw diagrams and explain cryptocurrency. Here’s one person’s diagram. You can see the miner here is very close to the admin.

So the takeaway that I want to leave you with is: let’s educate by creating surprising products. I call these “products that break people’s brains.”

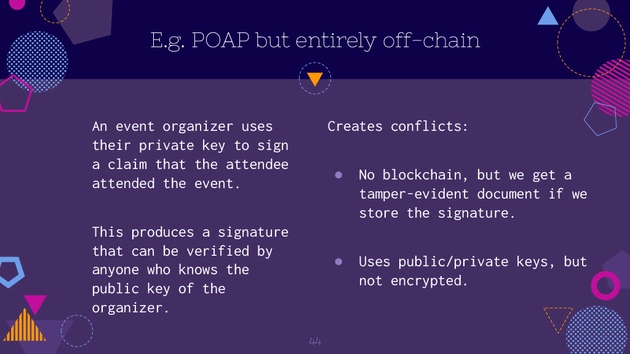

Example: POAP but entirely off-chain. The event organizer uses their private key to sign a claim that the attendee attended the event. Anyone can verify the signature. Importantly, this creates conflicts with the incorrect mental model. There’s no blockchain but we get a tamper-evident document if we store the signature. It uses public/private keys, but nothing is encrypted, everything in the clear.

We can fund the public good of knowledge by creating products that are excludable and are profitable. They’ll change people’s minds if they demonstrate something surprising in a plausible way. And, going against the common mental model might indicate a market opportunity.