In contract law, we are allowed to add custom rules, but we aren’t allowed to do the same in property law. Property (both real and virtual) has a limited number of forms. One explanation given by academics is that new forms of property would degrade the market for everyone else, because buyers would have to research what kind of strange rules were attached to the particular property they were considering.

NFTs—non-fungible property defined and transferred by smart contracts—might allow us to define custom properties in ways that don’t degrade the market in the same way. This is not a talk supportive of specific NFT projects (unfortunately, as is often the case in the blockchain world, many of the projects are scammy), but rather an attempt to connect traditional property law with the new affordances of smart contracts.

A big thanks to Joshua A.T. Fairfield’s 2015 paper Bitproperty for the introduction to property law concepts and the Merrill and Smith, and Heller papers.

Slides

Slides are unavailable as a pdf, but images of the slides are below.

Recording

Transcript

Thank you so much. I’m Kate Sills, a software engineer at Agoric. I’m the engineering lead on our smart contract framework.

Today I’m going to be talking about something a little bit different, that I hope you haven’t heard about before. It’s something that I’m actually particularly worried about. It’s at the intersection of law and economics and blockchain and that is: NFTs and engineering property rights.

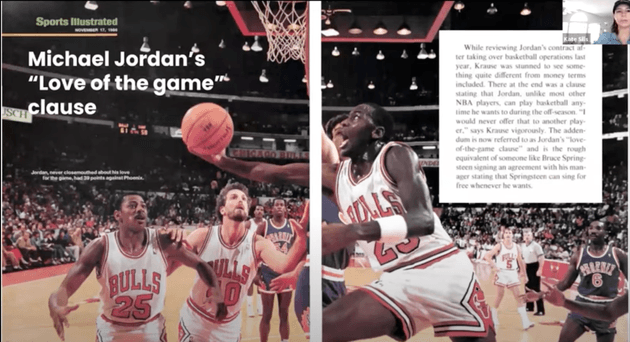

But first let’s start with our current legal system. In the US we have freedom of contract. You and I can make a contract about nearly anything. So for example, Michael Jordan famously had a contract with the Chicago Bulls that had a “love of the game” clause that allowed him to play basketball anytime and anywhere he wanted. Normally nba players were prohibited from playing basketball outside the NBA because of the risk of potential injury.

Contracts can be about nearly anything as long as it’s not criminal but property law is very different.

Property law is limited. There’s a limited number of standard forms that will be enforced by the legal system.

So, for instance, if I make a deal with Michael Jordan saying that he’s allowed to play basketball on my property at any time even after I sell it — that will not be enforced by the courts. The only difference from the Michael Jordan “love of the game” clause is that now we’re talking about property not contract.

So you might be asking why is that? Why is property law so different from contract law?

And the answer is that property rights are “in rem” meaning that their rights are in a thing. It’s the right to exclude the world from a thing that you own. Contract rights, by contrast, are “in persona.” They apply to particular people.

What does this mean? As a person in society I have to be aware of the boundaries of other people’s property—whether that’s land or other kinds of property rights, such as cars, books, what have you—but other people’s contracts are their business and that shouldn’t affect me.

Why does property have a limited number of forms?

It turns out that new forms of property can lead to higher transaction costs for everyone else because everyone else is affected.

Let’s go over an example. Normally when two parties buy or sell something it doesn’t have a huge negative effect on everyone else. Let’s say that Alice sells a baseball card to Bob.

All the other buyers and sellers in the baseball card market are pretty much unaffected. Maybe the price changes slightly but that’s it.

Now let’s say that Alice creates a new kind of property right. Alice takes her baseball card and decides to sell ownership of the card per day of the week, so you can own the card on a Monday, someone else can own it on Tuesday and someone else can own it on Wednesday. Let’s say that Alice sells the “Monday” right to Bob.

Now if Carol is buying a baseball card from Bob she has to ask Bob if she’s buying ownership just for Mondays or whether it’s the rights to the whole card — the usual rights that you would have to a baseball card.

Now, even if you aren’t interacting directly with Alice or Bob the search costs—the time that you spend investigating whether a deal is right for you—have gone way up. For every baseball card that you want to buy you have to make sure that there’s no weird side agreement. (In property law these are called fancies.) No fancies attached to it. Adding fancies makes the search costs for everyone else go up because they have to make sure that fancies aren’t attached to the property before they buy it.

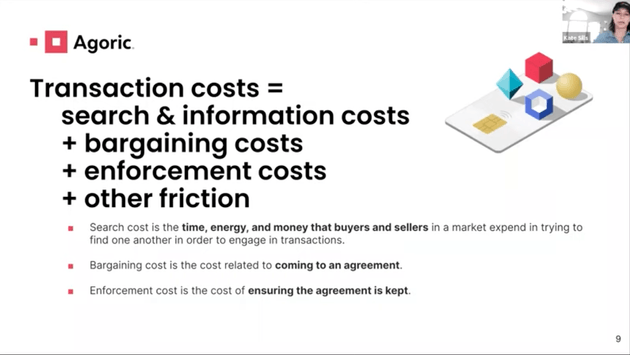

Search costs are a type of transaction costs. Transaction costs are:

- search and information costs

- plus bargaining costs

- plus enforcement costs

- plus any other kind of friction

Search cost is specifically the time energy and money expended when buyers and sellers try to find each other and assess what they might buy.

Bargaining cost is the cost of coming to an agreement.

Enforcement cost is the cost of enforcing or ensuring that the agreement is kept.

We’ve gone over the difference between property and contract law, and transaction costs, and we’ve explained why the law allows for idiosyncratic forms of contract but not property. That is because property is a right against the world and because property is a right against the world a new form affects everyone else negatively by increasing transaction costs, specifically, search costs.

How does this translate into the blockchain space?

Blockchains allow for the creation of property—that is, virtual intangible property—and the decentralized enforcement of transfer. There are two major types of virtual property on a blockchain:

- The first is fungible, as in the case of cryptocurrencies.For fungible tokens 20 tokens are indistinguishable from 20 other tokens of the same kind

- The second kind of tokens is known as non-fungible tokens (or nfts) These are often used for collectible items such as the cryptokitty seen here and the main distinguishing factor is that a non-fungible token has a unique identifier whereas fungible tokens do not.

I should note here that fungibility in the economic sense is in the eye of the beholder. If you want a cryptokitty and you don’t really care which one you get, then all cryptokitties are fungible with each other according to your perspective.

The economic meaning of fungibility is different than the technical distinction.

We’ve covered property on a blockchain but what about contracts? Blockchains have a thing called smart contracts. A smart contract is code that runs on a blockchain that either produces virtual property or transfers virtual property or some mix thereof and importantly it does so according to the rules specified in the code.

A smart contract is very different from a legal contract in that the enforcement mechanism of a smart contract is possession of the virtual property by the code itself.

As an example, let’s look at a time locked smart contract. Let’s say that Bob owns some tokens.

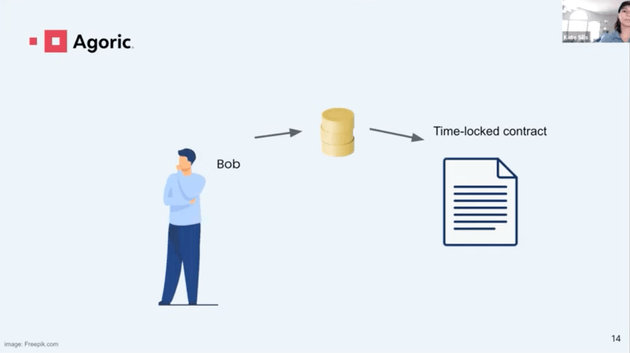

He sends the tokens to the time-locked contract. Now the contract has sole possession of the tokens. Bob has no access and per the code of the contract, the smart contract releases the tokens only after the expiration date.

The expiration date passes and the tokens are released back to Bob.

You can see there’s a number of really unusual things here: First, Bob is the only party. Bob is binding his own future actions. This is not something that a court would normally enforce — these contracts would be known as ulysses contract. Second, the enforcement mechanism as I mentioned is that Bob is actually handing over possession of the token to the code itself.

A similar thing happens with commercial trades on a blockchain. Let’s say that Alice and Bob want to trade their tokens with each other. They can do so securely by passing their tokens into the smart contract which takes possession of both sides of the trade…

…then swaps and releases them to Alice and Bob.

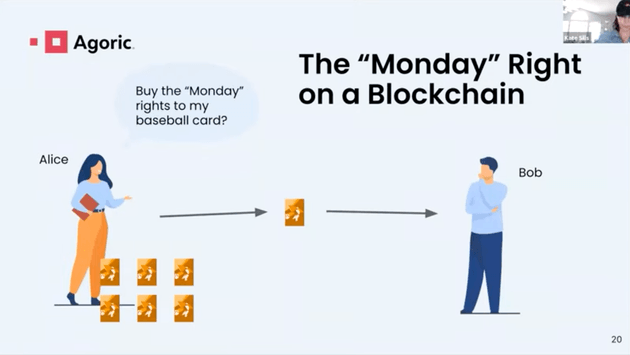

Let’s go back to the “Baseball Card on Mondays” example. How would this work on a blockchain?

Let’s say that the baseball card that Alice owns is a virtual baseball card or an NFT. Alice sells Bob the right to her virtual baseball card but just on Mondays. How does she do that? If Alice gives Bob her card on a Monday, unfortunately, Bob is now the full owner as far as the blockchain is concerned and Bob can run away with the card. Alice won’t ever get it back.

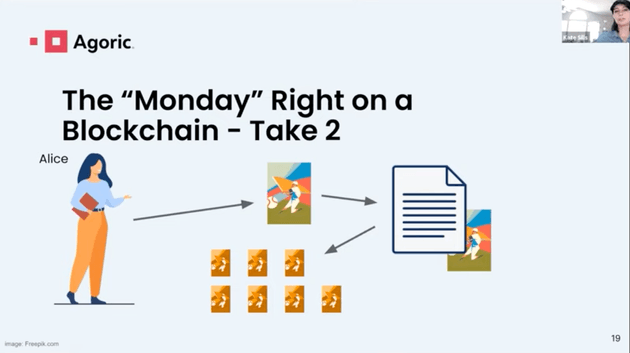

Instead, the blockchain way to do this is something like: Alice sends her virtual baseball card to a smart contract. The contract keeps her card in escrow and gives her back seven new cards, one for each of the days of the week.

Now, Alice can sell the Monday card to Bob and keep the rest for herself.

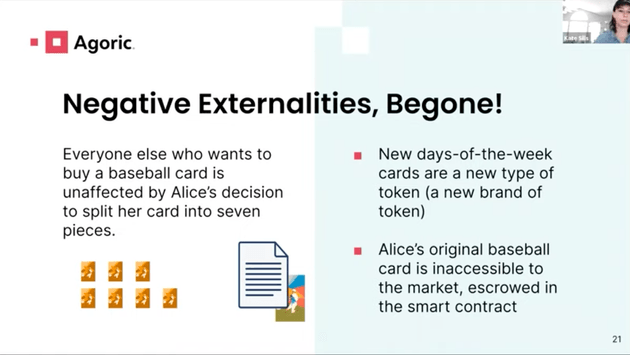

In smart contracts, compared to the real world, we don’t necessarily need to see the same kind of negative externalities. Everyone else who wants to buy a baseball card is unaffected by Alice’s decision to split her card into seven pieces.

What makes this blockchain case different from the real world case? The new “days of the week” cards are actually a new type of token (at Agoric, that’s what we would call a new brand of token). That means that it’s very easy to distinguish between the original cards and Alice’s monstrosity of a new property form.

When someone just wants to buy a baseball card, their search for the card will leave out Alice’s new tokens.

Additionally, because enforcement in smart contracts requires possession, the smart contract still holds the original nft but in a way that’s inaccessible to anyone else and so inaccessible to the market. So there’s no chance of someone accidentally coming across it.

In a smart contract on a blockchain we can create new forms of property without necessarily increasing search costs but we have another problem: fragmentation.

The problem of fragmentation is also known as the Tragedy of the Anti-commons. You may have heard of the Tragedy of the Commons in which a resource held in common is overused.

This is the opposite. This is underuse and it occurs when too many people own pieces of one thing such that no one can use it.

No one can use it, because bargaining costs are extremely high: each separate owner of the pieces has to be negotiated with to bring the pieces together to use the thing.

Here’s an example of the tragedy of the anti-commons that many of you might be familiar with: building property in the Bay Area. New buildings are almost always vetoed by one person or another so it’s nearly impossible to build.

Going back to our days of the week nfts —imagine if all of the owners of all of the parts had to agree before the card could be used.

For example, let’s imagine that Alice wants to put the original baseball card back together. How would we do that? In a smart contract on a blockchain, the technical mechanism would be that 1) you buy up all of the pieces, 2) send them back to the original smart contract and then 3) the original contract burns the pieces and 4) sends your nft back.

But what happens when you can’t collect all seven? What if some people don’t want to sell? What if they hold out for more money, knowing that six out of the seven pieces is not helpful to you and you actually need all seven?

This is known as the holdout problem in economics. In real life we have a few ways of trying to get around the holdout problem but it is a huge problem still. With smart contracts though, we can intentionally design the new tokens to prevent this problem.

One potential solution is NFTs that expire. When the smart contract makes the seven new pieces, those pieces can have an expiration date, at which time they will no longer be recognized. After the expiration date, the contract can safely send the original baseball card NFT back to Alice. Alice does not have to bargain with all of the owners of the pieces of her baseball card.

A well-designed property right will solve the problems of fragmentation.

In conclusion, property or smart contracts on a blockchain creates a new field where software engineering or designing nfts is actually engineering property rights.

Smart contracts and virtual property are tools that property rights engineers can use: tools for creating, splitting, and combining property in new ways.

Importantly, in a smart contract, anyone can alter and create new property rights without necessarily imposing high transaction costs on everyone else but that is only if we know and design around the economic problems that can occur with property rights.

I think this is fascinating and I hope if you’re an economist or a software engineer you think so too. Thank you.